The United Kingdom, a front-runner in the global drive towards sustainability, is launching the UK CBAM to curb carbon leakage and promote greener industrial practices. The UK was the first major economy to legislate a net-zero emissions target, aiming to slash emissions by half compared to 1990 levels.

By aspiring to generate clean power by 2030 and achieve net-zero emissions by 2050, the UK seeks to decarbonize its industries, potentially creating jobs and sustaining economic growth. Yet, achieving these goals is threatened by carbon leakage, where industries relocate production to countries with lenient emissions rules.

Now, the UK is introducing its own CBAM, designed to enforce a carbon price on imports analogous to UK-made goods.

What is the UK's CBAM?

The UK Carbon Border Adjustment Mechanism (CBAM) is a policy measure announced by the UK government to address carbon leakage and support decarbonization efforts. It is designed to apply a carbon price to imported carbon-intensive goods, ensuring that the carbon price of imports is equivalent to the carbon price of domestic production.

Essentially, the UK CBAM will impose a charge on imported products based on their carbon intensity, mirroring the carbon pricing mechanisms applied domestically. This aims to create a level playing field between domestic industries, which are already subject to carbon pricing, and imported goods.

How does the UK's CBAM work?

Scheduled to be implemented on January 1, 2027, the UK CBAM aims to equalize the carbon costs of imports from sectors highly susceptible to carbon leakage. This mechanism aspires to create a balanced playing field, where both UK-based industries and international counterparts share an equitable carbon responsibility, thereby promoting both fairness and accountability in environmental practices.

The UK's CBAM is designed to create a level playing field for carbon pricing:

Carbon Price Equalization

The mechanism aims to ensure that imports face a carbon cost similar to domestically produced goods. This is done by placing a carbon price on emissions-intensive industrial goods imported to the UK.

Emissions Assessment

The CBAM will assess the embodied emissions in imported goods, covering both direct emissions generated during the production process and indirect emissions related to producing electricity used in manufacturing.

Liability Calculation

The CBAM liability will be calculated based on the greenhouse gas emissions intensity of the imported goods and the difference between the carbon price applied in the country of origin and the price that would have been applied if the goods had been produced in the UK.

Adjustment for Existing Carbon Pricing

The UK CBAM is designed so that imports from countries with explicit carbon pricing will have their CBAM liability adjusted accordingly.

Integration with UK ETS

The UK CBAM will work cohesively with the UK Emissions Trading Scheme (ETS), including free allowances, to ensure imported products are subject to a carbon price comparable to that incurred by UK production.

By implementing these measures, the UK aims to address carbon leakage, reinforce its leadership in global climate initiatives, and foster sustainable economic growth while maintaining the competitiveness of domestic industries.

What are the requirements of the UK's CBAM?

Initially, the CBAM will target imports associated with significant carbon leakage risks, including aluminum, cement, fertilizers, hydrogen, and iron and steel. Interestingly, products from the glass and ceramics sectors will remain outside the early scope of CBAM.

This initiative requires importers to register, periodically submit returns, and uphold transparent records of the carbon metrics of their imports. Such a structured approach aims to maintain minimal compliance complexities while enabling effective monitoring and regulation.

The UK's CBAM will have several key requirements:

Sector Coverage

Initially, the CBAM will target imports associated with significant carbon leakage risks, including aluminum, cement, ceramics, fertilizers, glass, hydrogen, and iron and steel.

Registration and Reporting

Importers will be required to register, periodically submit returns, and maintain transparent records of the carbon metrics of their imports.

Emissions Scope

The UK CBAM will apply to Scope 1 (direct emissions), Scope 2 (indirect emissions related to electricity production), and select precursor product emissions embodied in imported products.

Carbon Price Calculation

The liability applied by CBAM will depend on the greenhouse gas emissions intensity of the imported good and the gap between the carbon price applied in the country of origin (if any) and the carbon price that would have been applied had the good has been produced in the UK.

Liability

CBAM's liability will lie directly with the importer of imported products within the scope of the UK CBAM.

Commodity Codes In-scope of the UK’s CBAM

Below is a list of the Combined Nomenclature (CN) Code, the affected material, description, and the emitting Greenhouse Gases (GHGs).

Aluminum

- 7601 — Unwrought aluminium — Carbon dioxide and perfluorocarbons

- 7603 — Aluminium powders and flakes — Carbon dioxide and perfluorocarbons

- 7604 — Aluminium bars, rods and profiles — Carbon dioxide and perfluorocarbons

- 7605 — Aluminium wire — Carbon dioxide and perfluorocarbons

- 7606 — Aluminium plates, sheets, and strip, of a thickness exceeding 0.2 mm — Carbon dioxide and perfluorocarbons

- 7607 — Aluminium foil (whether or not printed or backed with paper, paper-board, plastics or similar backing materials) of a thickness not exceeding 0.2 mm — Carbon dioxide and perfluorocarbons

- 7608 — Aluminium tubes and pipes — Carbon dioxide and perfluorocarbons

- 7609 00 00 — Aluminium tube or pipe fittings (for example, couplings, elbows, sleeves) — Carbon dioxide and perfluorocarbons

- 7610 — Aluminium structures (excluding prefabricated buildings of heading 9406) and parts of structures (for example, bridges and bridge-sections, towers, lattice masts, roofs, roofing frameworks, doors and windows and their frames and thresholds for doors, balustrades, pillars and columns); aluminium plates, rods, profiles, tubes, and the like, prepared for use in structures — Carbon dioxide and perfluorocarbons

- 7611 00 00 — Aluminium reservoirs, tanks, vats, and similar containers, for any material (other than compressed or liquefied gas), of a capacity exceeding 300 litres, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment — Carbon dioxide and perfluorocarbons

- 7612 — Aluminium casks, drums, cans, boxes, and similar containers (including rigid or collapsible tubular containers), for any material (other than compressed or liquefied gas), of a capacity not exceeding 300 litres, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment — Carbon dioxide and perfluorocarbons

- 7613 00 00 — Aluminium containers for compressed or liquefied gas — Carbon dioxide and perfluorocarbons

- 7614 — Stranded wire, cables, plaited bands, and the like, of aluminium, not electrically insulated — Carbon dioxide and perfluorocarbons

- 7616 — Other articles of aluminium — Carbon dioxide and perfluorocarbons

Cement

- 2507 00 80 — Other kaolinic clays — Carbon dioxide

- 2523 10 00 — Cement clinkers — Carbon dioxide

- 2523 21 00 — White Portland cement, whether or not artificially coloured — Carbon dioxide

- 2523 29 00 — Other Portland cement — Carbon dioxide

- 2523 30 00 — Aluminous cement — Carbon dioxide

- 2523 90 00 — Other hydraulic cements — Carbon dioxide

Fertilizer

- 2808 00 00 — Nitric acid; sulphonitric acids — Carbon dioxide and nitrous oxide

- 2814 — Ammonia, anhydrous or in aqueous solution — Carbon dioxide

- 2834 21 00 — Nitrates of potassium — Carbon dioxide and nitrous oxide

- 3102 — Mineral or chemical fertilisers, nitrogenous — Carbon dioxide and nitrous oxide

- 3105 — Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, phosphorus, and potassium; other fertilisers; goods of this chapter in tablets or similar forms or in packages of a gross weight not exceeding 10 kg — Carbon dioxide and nitrous oxide

Hydrogen

- 2804 10 00 — Hydrogen — Carbon dioxide

Iron and Steel

- 2601 12 00 — Agglomerated iron ores and concentrates, other than roasted iron pyrites — Carbon dioxide

- 72 — Iron and steel — Carbon dioxidesome text

- Exceptions:some text

- 7202 20 00 — Ferro-silicon

- 7202 30 00 — Ferro-silico-manganese

- 7202 50 00 — Ferro-silico-chromium

- 7202 70 00 — Ferro-molybdenum

- 7202 60 00 — Ferro-tungsten and ferro-silico-tungsten

- 7202 81 00 — Ferro-titanium and ferro-silico-titanium

- 7202 92 00 — Ferro-vanadium

- 7202 98 00 — Ferro-niobium

- 7202 99 10 — Ferro-phosphorus

- 7202 99 30 — Ferro-silico-magnesium

- 7202 99 80 — Other

- 7204 — Ferrous waste and scrap; remelting scrap ingots and steel

- Exceptions:some text

- 7301 — Sheet piling of iron or steel, whether or not drilled, punched, or made from assembled elements; welded angles, shapes, and sections, of iron or steel — Carbon dioxide

- 7302 — Railway or tramway track construction material of iron or steel, including rails, check-rails, sleepers, and base plates — Carbon dioxide

- 7303 00 — Tubes, pipes, and hollow profiles, of cast iron — Carbon dioxide

- 7304 — Tubes, pipes, and hollow profiles, seamless, of iron (other than cast iron) or steel — Carbon dioxide

- 7305 — Other tubes and pipes (e.g., welded, riveted, or similarly closed), with circular cross-sections and external diameter exceeding 406.4 mm, of iron or steel — Carbon dioxide

- 7306 — Other tubes, pipes, and hollow profiles (e.g., open seam or welded, riveted, or similarly closed), of iron or steel — Carbon dioxide

- 7307 — Tube or pipe fittings (e.g., couplings, elbows, sleeves), of iron or steel — Carbon dioxide

- 7308 — Structures (excluding prefabricated buildings) and parts of structures (e.g., bridges, doors, windows), of iron or steel; plates, rods, and sections, prepared for use in structures — Carbon dioxide

- 7309 00 — Reservoirs, tanks, vats, and similar containers for any material (excluding compressed or liquefied gas), of iron or steel, with capacity exceeding 300 liters, unlined or not heat-insulated — Carbon dioxide

- 7310 — Tanks, casks, drums, cans, boxes, and similar containers, for any material (excluding compressed or liquefied gas), of iron or steel, with capacity not exceeding 300 liters, unlined or not heat-insulated — Carbon dioxide

- 7311 00 — Containers for compressed or liquefied gas, of iron or steel — Carbon dioxide

- 7318 — Screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers (including spring washers), and similar articles, of iron or steel — Carbon dioxide

- 7326 — Other articles of iron or steel — Carbon dioxide

When does the UK make CBAM mandatory?

The framework relevant to CBAM compliance will take effect at the beginning of 2027. This timeline is strategically aligned with the broader decarbonization markdown laid out by the UK, providing industries with a necessary transition period to adapt and meet the new, robust standards.

The UK CBAM isn't just a domestic policy initiative but part of a synchronized international effort to mitigate climate change. It aligns closely with similar schemes, like the EU CBAM, which initiated its transitional phase on October 1, 2023.

The UK's endeavour to harmonize efforts with global partners underscores its commitment to a cohesive and collaborative approach to carbon pricing and leakage prevention.

Who needs to comply with the UK's CBAM?

Businesses involved in importing goods from the identified high-risk sectors will be required to comply. This includes entities dealing specifically with aluminum, cement, fertilizers, hydrogen, and iron and steel products.

The scope of compliance for the UK's CBAM extends beyond just importers:

Importers

Businesses that import goods from the identified high-risk sectors will be the primary entities required to comply. This includes companies dealing with aluminum, cement, fertilizers, hydrogen, and iron and steel products.

.

Manufacturers

While not directly importing, manufacturers using materials from these sectors may need to ensure their supply chain is CBAM-compliant to avoid disruptions.

Distributors

Companies that distribute products containing materials from the affected sectors may need to verify their suppliers' CBAM compliance.

Retailers

Large retailers importing goods directly from non-UK sources in the specified sectors must also comply.

Logistics and Supply Chain Companies

These entities may need to adapt their processes to accommodate CBAM requirements for their clients.

Why should you care about the UK's CBAM?

With the enforcement date of the UK CBAM drawing nearer, the urgency for businesses to understand and comply cannot be overstated. Non-compliance poses risks of financial penalties and potential market disruption, as products lacking adherence to UK or global carbon standards may face restrictions or outright denial of entry. Conversely, compliance could enhance competitive advantage by signalling a company's dedication to sustainable practices.

How can Arbor help you with the UK's CBAM?

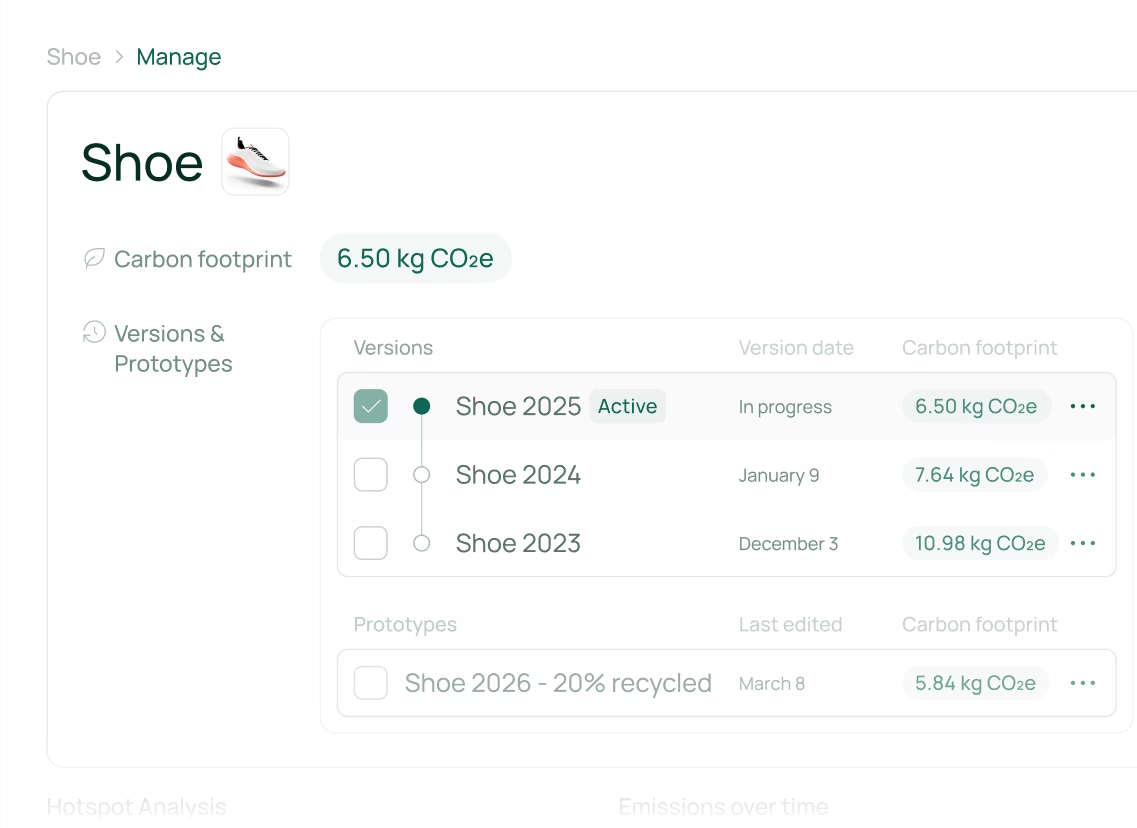

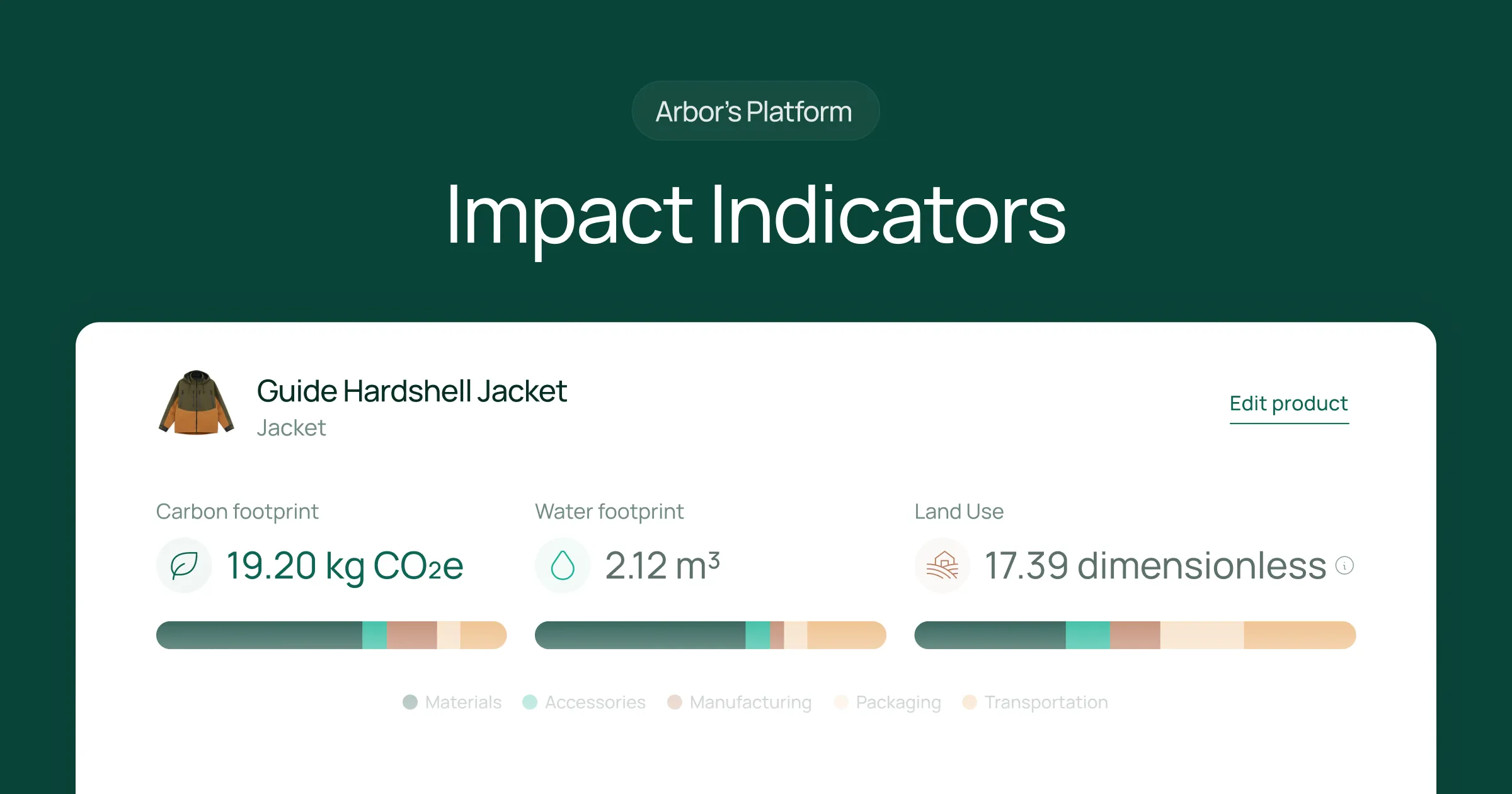

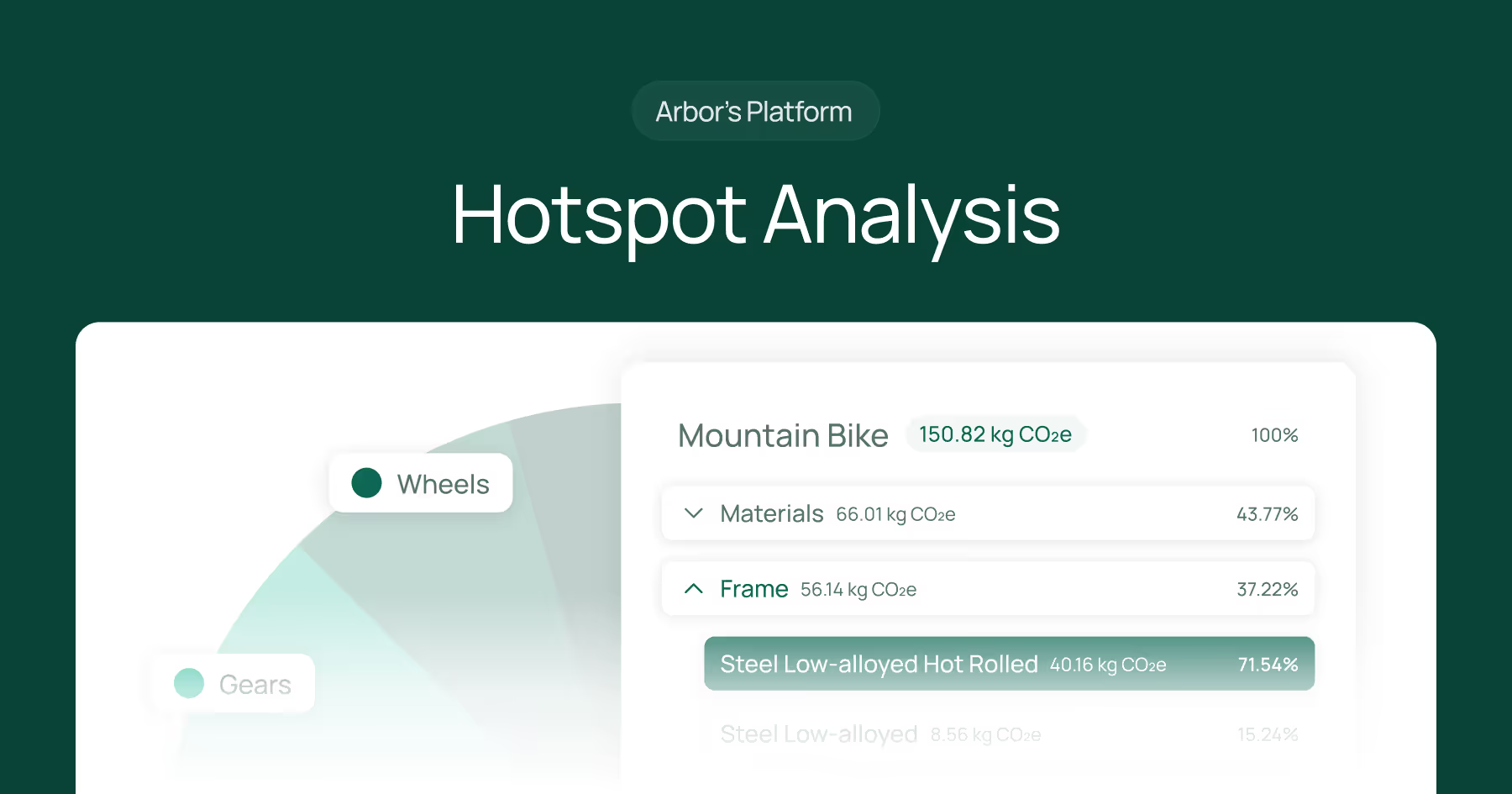

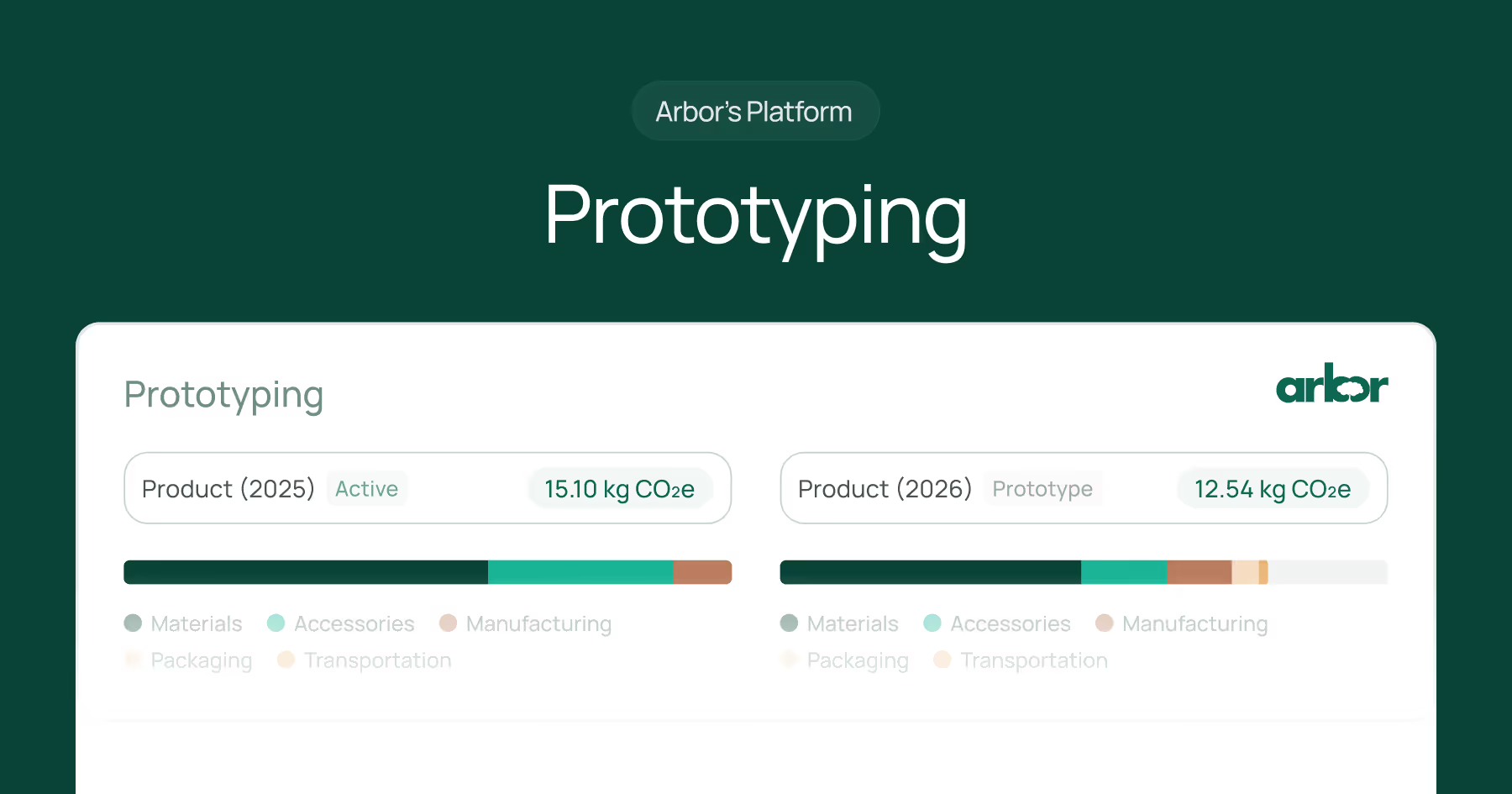

Arbor offers an easy-to-use carbon accounting platform specifically designed to empower businesses to accurately measure, manage, and reduce their carbon footprint across all emission scopes.

Arbor's tool provides highly precise carbon calculations and actionable insights down to the supplier level, making it seamless for UK businesses to uphold CBAM requirements, ensuring compliance and maintaining a competitive edge.

Our platform can manage thousands of SKUs with unmatched precision, aligns with international standards, and remains a cornerstone for data-backed regulatory and marketing claims.

Summary

As the 2027 implementation date approaches, businesses are encouraged to understand the nuances of the CBAM requirements and to align supply chains. Continued guidance and support from the government are anticipated, facilitating a smoother transition and enforcement process.

In summary, the UK's CBAM is poised to significantly impact the journey towards net-zero emissions while sustaining the competitiveness and ability of domestic industries to thrive. Addressing carbon leakage, the UK reinforces its leadership in global climate initiatives and commits to fostering sustainable economic growth. As businesses gear up for these pivotal changes, staying informed and prepared is paramount to navigating the evolving landscape.

Request a demo of Arbor’s platform to see how easy it is to measure emissions for the UK’s CBAM.

Measure your carbon emissions with Arbor

Simple, easy carbon accounting.

FAQ about the UK’s CBAM:

Is CBAM applicable to the UK?

The UK is not part of the EU's Carbon Border Adjustment Mechanism (CBAM) but is set to implement its own version starting in 2027. The UK’s CBAM will target imports of certain carbon-intensive goods that enter the UK market.

What is the difference between EU CBAM and UK CBAM?

The UK CBAM includes some sectors that are not covered by the EU CBAM, such as ceramics and glass, while excluding electricity, which is included in the EU CBAM. Unlike the EU's system, the UK CBAM will not use a certificate system but will directly apply a carbon levy on imports.

What is the threshold for CBAM in the UK?

The proposed registration threshold for the UK CBAM is £10,000 in imports within relevant customs codes on a rolling 12-month basis for each importer of record. However, another figure of £50,000 has been mentioned, indicating that the threshold may still be under consideration.

Will CBAM replace ETS?

No, the CBAM will not replace the Emissions Trading System (ETS) in the UK. The UK CBAM is designed to complement the existing UK ETS, providing a cohesive framework for managing carbon emissions.

Which countries are considering CBAM?

Beyond the EU and the UK, other countries have started exploring their own CBAM systems. Nations such as Australia, Canada, and Turkey are considering implementing CBAM measures.

Who does CBAM apply to?

The UK CBAM will target importers bringing carbon-intensive goods into the UK. These goods fall within sectors like aluminum, cement, ceramics, fertilizer, glass, hydrogen, and iron and steel.

Who pays the CBAM tax?

In the UK, liability for the CBAM tax generally falls on the importer of record for the applicable goods or the person responsible when the goods are released into free circulation.

Does CBAM violate WTO?

The compatibility of CBAM systems with World Trade Organization (WTO) rules remains under debate. Efforts are being made to design CBAMs that align with international trade rules to avoid disputes.

What goods does CBAM cover?

The UK CBAM focuses on certain carbon-intensive imported goods. The sectors it covers include aluminum, cement, ceramics, fertilizer, glass, hydrogen, and iron and steel.

What are the 6 sectors of CBAM?

The UK CBAM will initially cover seven sectors: aluminum, cement, ceramics, fertilizer, glass, hydrogen, and iron and steel.

What is the CBAM requirement?

Importers will need to report the embedded carbon emissions in covered goods and pay a carbon levy based on these emissions. This levy will be adjusted for any carbon price already paid in the country of origin.

What is the purpose of CBAM?

The primary purpose of CBAM is to mitigate carbon leakage and ensure that imported products bear a carbon cost comparable to that of domestic production. This aims to promote global decarbonization efforts.

What is the UK equivalent of CBAM?

Starting in 2027, the UK will implement its own version of CBAM, known as the UK CBAM. While similar to the EU CBAM, it will have distinct differences in design and sectoral scope.

How much will CBAM cost?

The cost of CBAM will vary based on the carbon emissions embedded in imported goods and the discrepancy between carbon pricing in the country of origin and the UK. Detailed cost estimates are yet to be released.

What are the new CBAM rules?

The UK CBAM rules are currently being finalized, with a consultation open until June 2024. Key elements include the coverage of seven sectors, applications from 2027, requirements for emissions reporting, and payment of a carbon levy on imports, adjusted for overseas carbon prices paid.

.webp)

%20Arbor.avif)

%20Arbor.avif)

.avif)

%20Arbor%20Canada.avif)

.avif)

%20Arbor.avif)

.avif)

_.avif)

.avif)

%20Arbor.avif)

%20Software%20and%20Tools.avif)

.avif)

.avif)

%20EU%20Regulation.avif)

.avif)

%20Arbor.avif)

_%20_%20Carbon%20101.avif)

.avif)

.avif)

.avif)

.avif)