Climate change is no longer a distant threat but instead an immediate challenge. The financial sector stands on the frontline, navigating the risks and opportunities this global phenomenon brings. Recognizing this evolving landscape, the Office of the Superintendent of Financial Institutions (OSFI) in Canada has introduced Guideline B-15, a pivotal regulatory framework designed to fortify the resilience and sustainability of Federally Regulated Financial Institutions (FRFIs) against climate-related risks.

We’ve detailed the provisions of Guideline B-15. This article delves into what FRFIs must do from a governance, strategic, risk management and systems perspective to be B-15 ready.

How does B-15 affect FRFIs?

Guideline B-15 aims to ensure that financial institutions in Canada are adequately prepared to address climate-related risks and contribute to a greener future. The B-15 Guideline looks at enhancing the following areas for FRFIs to incorporate into their strategic and governance processes:

- Strengthened Governance: FRFIs must enhance or improve their governance frameworks to oversee financial risks associated with extreme climate events effectively. This could mean new roles and responsibilities for senior management and board members.

- Enhanced Risk Management: FRFIs must enhance their risk management practices to identify, assess and manage financial risks and uncertainties associated with climate change.

- Stress Testing of Strategies: The B-15 Guideline also advocates using scenario analysis and stress testing to assess the impacts of climate-related risks on the FRFIs' business strategy, financial condition, risk profile, and business model.

- Improved Disclosure of Metrics & Targets: The B-15 Guidelines will require FRFIs to improve their disclosures regarding climate-related financial risks. This move will increase transparency and help stakeholders understand how these institutions manage climate change's potential financial implications.

The next section explains how FRFIs can prepare for these guidelines by enhancing the above processes in Governance, Strategy, Risk Management and Metrics & Targets.

Governance

B-15 expects the FRFI’s board of directors and senior management to be accountable for its overall climate risk management. The FRFI should also consider whether and how senior management compensation policies and practices should incorporate climate-related risk considerations.

FRFIs need to consider the following changes in the governance structure at the board and management level to incorporate climate-related risks and opportunities.

Board level

B-15 highlights the need for the board of directors to understand and drive the climate risk strategy for the organization. The following changes, if not yet implemented, would enable the board to drive changes at the organization level:

- Build capacity at the board level in climate risk and mitigation. This could include adding board members with experience in this area or holding training sessions to build overall board expertise in these areas.

- The FRFI’s risk management committee must incorporate climate-related risks and opportunities into its processes and risk registers.

Management's Role

The senior management would be responsible for setting and executing the climate strategy. To effectively embed climate risk management into their strategy, FRFIs may consider doing the following:

- Establish a climate risk, ESG, or sustainability team focused on the development, execution and updation of the climate risk strategy and the climate action plan.

- The senior management of the above-created team should be included in the risk committee meetings to inform and influence the organization's climate risk strategy

The management team can also be responsible for, in addition to other items:

- Understanding best practices in the industry and the ever-changing disclosure requirements.

- Developing systems and processes to track the FRFI’s data associated with climate-related risks and opportunities.

- Tracking and developing disclosures for both internal and external stakeholders.

- Identifying and understanding the impact of climate-related risks on the FRFI's short-term and long-term strategic, capital, and financial plans.

Risk Management

Guideline B-15 requires FRFIs to integrate climate-related risks into its Risk Appetite Framework and Enterprise Risk Management (ERM) framework. This means that climate-related risks and opportunities now must be part of the organization’s overall risk framework. Processes and controls to identify and measure the present and future impact of climate-related risks on its portfolio of exposures (e.g., credit, market, operational, insurance, and liquidity) must also be included.

“Climate-related risks” are broadly categorized as physical and transition risks.

- “Physical risks” refer to the financial risks from the increasing severity and frequency of climate-related extremes and events (i.e., acute physical risks), longer-term gradual shifts of the climate (i.e., chronic physical risks), and indirect effects of climate change such as public health implications (e.g., morbidity and mortality impacts).

- “Transition risks” refer to the financial risks related to adjusting toward a low greenhouse gas (GHG) economy. These risks can emerge from current or future government policies, legislation, and regulations to limit GHG emissions, technological advancements, and changes in market and customer sentiment toward a low-GHG economy.

Risk Identification Process

The teams responsible for identifying climate-related risks and opportunities would need to incorporate the above risks of climate change into their risk management practices. This may also involve internal policy and process changes.

The Taskforce for Climate-Related Financial Disclosures (TCFD), the recommendations of which are consistent with the IFRS S2 Standard, lays out a list of possible physical and transitional risks and opportunities for FRFIs to consider as part of their risk identification processes. Based on these findings, FRFIs would need to look at their current portfolio to identify the effects on their financial statements, cashflows, insurance claims, and other key financial metrics that could materially affect investment.

Strategy

Financial Implications

According to Catastrophe Indices and Quantification Inc. (CatIQ), Canada incurred $3.1 billion in insured damage from natural catastrophes and severe weather events. 2023 was Canada's fourth-worst year for insured losses, highlighting the financial costs of a changing climate to insurers, governments and taxpayers. This also has implications for investments made by banks and Financial Institutions and highlights the reality that climate risk needs to be incorporated into the strategies of these organizations.

B-15 enables FRFIs to embed climate-related risks and opportunities in the organization’s core strategy. Key items that B-15 includes in its guidance are the Climate Action Plan and the Standardized Climate Scenario Exercise.

Climate Action Plan

The B-15 Guideline requires that

“the FRFI should develop and implement a Climate Transition Plan (Plan), in line with its business plan and strategy, that guides the FRFI’s actions to manage increasing physical risks from climate change, and the risks associated with the transition towards a low GHG economy. In developing the Plan, the FRFI should assess the achievability of its Plan under different climate-related scenarios and how it would measure and assess its progress against the Plan (e.g., internal metrics and targets such as GHG emissions).”

The B-15 Guideline builds upon the IFRS S2 climate-related disclosures, which detail additional information on the plan's components. OSFI is finalizing further details on the Climate Action Plan.

Standardized Climate Scenario Exercise

As part of understanding the current and anticipated effects of climate-related risks and opportunities on the FRFI’s business model and value chain, OSFI is currently developing a Standardized Climate Scenario Exercise (SCSE) to enable OSFI to assess aggregate exposures to physical and transition risks and compare FRFI approaches to climate scenario analysis. This exercise will also help FRFIs identify the key conditions and scenarios they need to consider as part of their climate scenario exercise, thus enabling a standardized process to understand the effects of climate-related risks and opportunities on their business model and key financial KPIs.

The SCSE expects four separate modules and a questionnaire that the FRFIs will be expected to fill out. The modules are detailed in the table below:

.avif)

OSFI plans to finalize the SCSE Methodology, SCSE Workbook, associated SCSE Instructions, supporting data, and questionnaire by the end of 2024.

Find more details of the Standardized Climate Scenario Exercise.

Metrics and Targets

Finally, B-15 provides a list of metrics and targets that FRFIs must collect and report on. The list of metrics and targets to be reported according to the B-15 guidelines is detailed below.

Risk Assessment Metrics

The risk assessment metrics are those metrics used by the FRFI in the climate risk process. To aid with the process, OSFI has released the Climate Risk Returns that will collect standardized climate-related data on emissions and exposures from FRFIs. These returns will need to be filled out by the FRFIs and provided to OSFI. Information that OSFI will confidentially collect as part of the Climate Risk Returns include:

- Asset exposures that are subject to physical risk for Deposit-Taking Institutions

- Underwritten physical risk exposures, such as claims, insurance revenue and Probable Maximum Loss (PML), for select lines of businesses and insurers

- Absolute GHG emissions (Scopes 1, 2 and 3) These are explained in the next section.

The metrics associated with this exercise should help FRFIs understand what metrics would need to be reported on and enable organizations to collect data and set processes to report on these metrics.

Scope 1, 2 and 3 Emissions

This is split into two main parts:

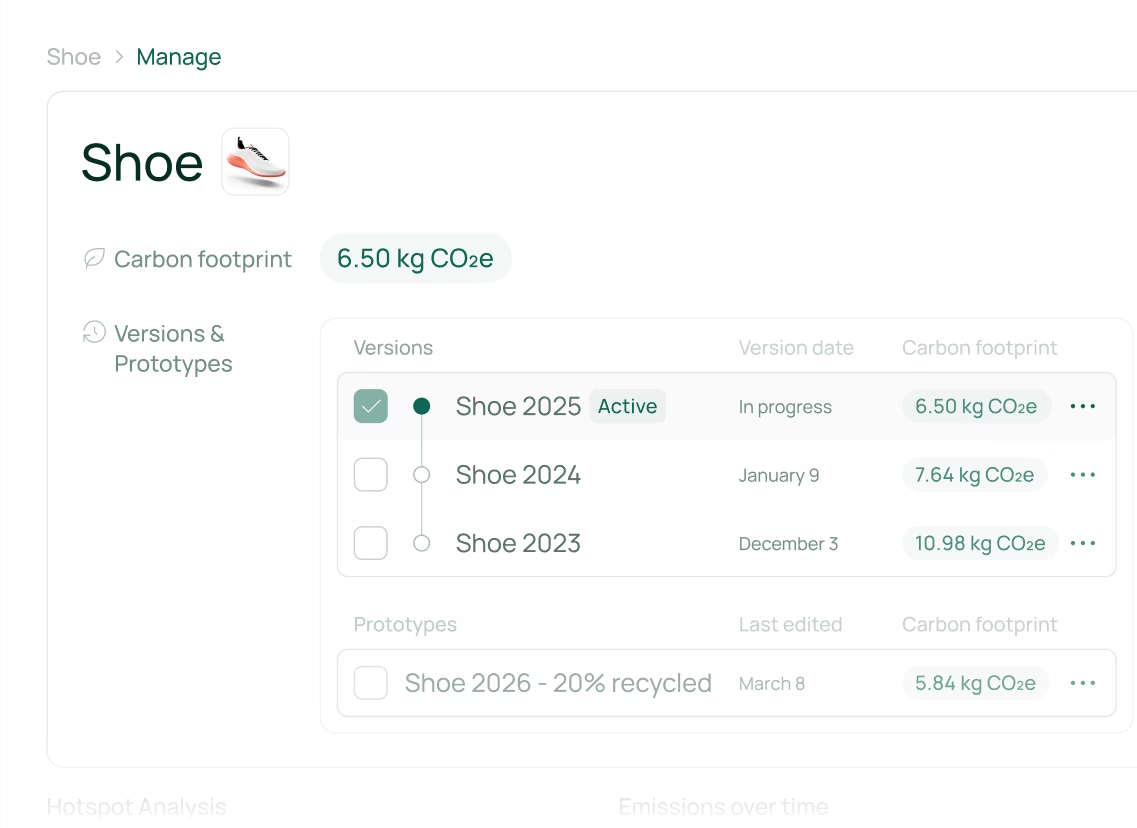

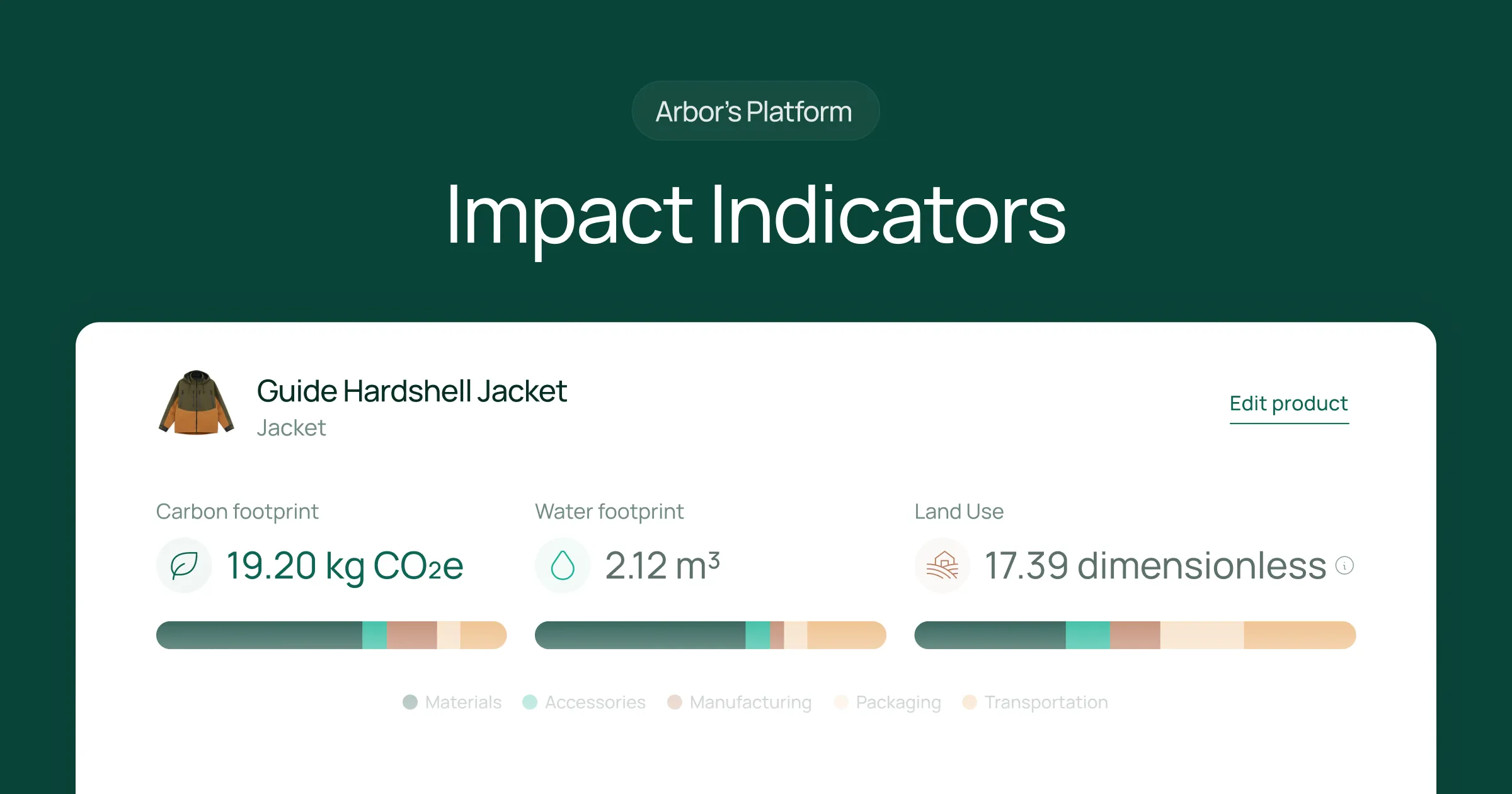

- FRFIs must disclose the metrics, methodology, and reporting standards for their Scope 1 and Scope 2 GHG emissions. The GHG Protocol Corporate Standard, which Arbor’s solutions are based on, outlines how organizations can calculate their Scope 1 and 2 emissions.

- FRFIs will also need to disclose their Scope 3 emissions. This includes:some text

- Emissions associated with their absolute gross GHG emissions, including the entire value chain. The GHG Protocol Scope 3 emissions standard details how to calculate Scope 3 value chain-based emissions.

- Included within Scope 3 emissions is Category 15: Investments. For an FRFI, these emissions are associated with the FRFI’s investees and borrowers and are also known as financed emissions. The Partnership for Carbon Accounting Financials (PCAF) Standard is a global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the GHG emissions associated with their loans and investments. The financed emissions module lays out the methodologies that FRFIs can use to calculate financed emissions.

- B-15 specifically mandates that insurance companies provide emissions associated with the insurer’s policyholders, also known as insurance-related emissions. The PCAF Insurance-related standard lays out how insurers calculate insurance-related emissions.

- PCAF provides a data quality scoring system for financial institutions. This methodology allocates scores from 1 to 5, where score 1 signifies the highest data quality and reliability level and score 5 indicates the lowest. A high score heavily depends on the amount of primary data used throughout the emissions assessments.

Strategic Goals

Under Guideline B-15, metrics and targets in the Climate Action Plan or any other strategic document created by the FRFI would need to be disclosed.

Cross-Industry & Industry-Specific Metrics

Guideline B-15 requires FRFIs to disclose cross-industry metrics such as:

- Climate-related transition risks: the amount and percentage of assets or business activities vulnerable to climate-related transition risks;

- Climate-related physical risks: the amount and percentage of assets or business activities vulnerable to climate-related physical risks;

- Climate-related opportunities: the amount and percentage of assets or business activities aligned with climate-related opportunities;

- Capital deployment: the amount of capital expenditure, financing or investment deployed towards climate-related risks and opportunities;

- Internal carbon price:some text

- An explanation of whether and how the FRFI is applying a carbon price in decision-making (for example, investment decisions, transfer pricing and scenario analysis) and

- The price for each metric tonne of GHG emissions the entity uses to assess the costs of its GHG emissions

- Remuneration:

- D-SIBs and IAIGs must also disclose the percentage of Senior Management and other material risk-takers remuneration recognized in the current period that is linked to climate-related considerations.

Industry-based Metrics

B-15 also recommends that FRFIs disclose Industry-based metrics. B-15 recommends topics associated with disclosure described in the Industry-based Guidance on Implementing IFRS S2 Climate-related Disclosures to disclose the metrics associated with the financial sector.

FRFIs Engagement With OSFI

Stakeholder engagement, particularly regular consultation with OSFI, the industry regulator, is crucial to ensuring the FRFIs' compliance with regulatory expectations. Engaging with OSFI will help to understand expectations clearly and minimize ambiguity regarding the guidelines. This will guarantee effective compliance with the requirements of the guideline and eliminate breaches.

In addition, FRFIs may need to engage proactively with OSFI, considering the evolving nature of climate risk, to create a feedback loop that can inform potential amendments to Guideline B-15. Regular engagement will ensure the guideline's requirements are updated, accurately interpreted and implemented. This will further assist FRFIs in improving their internal risk management frameworks and improve the confidence of other stakeholders such as shareholders, investors, clients, and other industry regulators.

To enable communication and engagement, OSFI has organized the Climate Risk Forum, a forum for partners, contributors, and OSFI to work together to enhance the B-15 guidelines and communication on climate risk management.

Summary

In conclusion, Guideline B-15 presents various opportunities for FRFIs to incorporate core climate-related policies, capacity building, systems, and processes to ensure that they can effectively incorporate climate change into their products and services and effectively manage their assets and investments. It is expected to help FRFIs enhance their climate risk management practices. The boards and senior management of every organization in the industry must establish clear governance frameworks to oversee climate risks, and this will require putting in place dedicated teams to develop and execute their climate strategies.

The guideline requires comprehensive climate-related data disclosure, including Scope 1, 2, and 3 emissions, climate risk exposures, and performance against climate targets. Financial institutions are encouraged to follow standardized frameworks like the Partnership for Carbon Accounting Financials (PCAF) to ensure consistent and transparent reporting. Collaboration with OSFI, especially through the Climate Risk Forum, is essential for effective implementation and adaptation as climate-related risks evolve.

Chat with Arbor's carbon experts to navigate and measure emissions for Guideline B-15.

Measure your carbon emissions with Arbor

Simple, easy carbon accounting.

%20Directive.webp)

.webp)

%20Arbor.avif)

%20Arbor.avif)

.avif)

%20Arbor%20Canada.avif)

.avif)

%20Arbor.avif)

.avif)

_.avif)

.avif)

%20Arbor.avif)

%20Software%20and%20Tools.avif)

.avif)

.avif)

%20EU%20Regulation.avif)

.avif)

%20Arbor.avif)

_%20_%20Carbon%20101.avif)

.avif)

.avif)

.avif)