California's Climate-Related Financial Risk Act, also known as Senate Bill 261 (SB 261), is a groundbreaking piece of legislation to enhance corporate transparency and accountability regarding climate-related financial risks.

Signed into law in October 2023, SB 261 requires certain businesses operating in California to disclose their climate-related financial risks and the measures they're taking to address them.

There have been significant updates to SB 261’s enforcement in recent weeks.

Current Status of SB 261: Enforcement Paused

A court injunction has temporarily paused mandatory enforcement, and CARB has opened a voluntary docket for companies to submit reports.

Now, let’s get into the details of SB 261, once the pause lifts.

What is California’s Climate-Related Financial Risk Act (SB 261)?

SB 261 is a state law that mandates large companies doing business in California to prepare and publicly disclose biennial reports on their climate-related financial risks. This act is part of California's broader efforts to combat climate change and promote sustainable business practices.

How does SB 261 work?

Under SB 261, covered entities are statutorily required to prepare a biennial report. However, due to a court injunction on November 18, 2025, mandatory enforcement is currently paused. Companies are instead encouraged to submit reports to a voluntary docket.

These should follow the Task Force on Climate-Related Financial Disclosures (TCFD) framework.

While the TCFD framework includes a "Metrics & Targets" pillar, CARB has clarified that for the initial 2026 report, disclosing Scope 1, 2, and 3 emissions is not a minimum requirement. This is to avoid duplication with SB 253 and allow companies time to build expertise.

The California Air Resources Board (CARB) will contract with a non-profit climate reporting organization to review these reports and prepare a public analysis of the disclosures. This analysis will identify any inadequate or insufficient reports and provide insights into systemic and sector-wide climate-related financial risks facing the state.

What are the requirements of SB 261?

The key requirements of SB 261 include:

- Disclosure of climate-related financial risks in accordance with TCFD recommendations.

- Reporting on measures adopted to reduce and adapt to identified climate-related financial risks.

- Making the report publicly available on the company's website.

- Submitting a statement to the Secretary of State affirming that the report discloses climate-related financial risk.

When does SB 261 become mandatory?

SB 261’s statutory deadline remains January 1, 2026, but mandatory enforcement is currently enjoined (paused) pending a legal appeal. Covered entities are encouraged to voluntarily post a link to their report in a CARB docket open from December 1, 2025, to July 1, 2026.

Who needs to comply with SB 261?

SB 261 applies to corporations, partnerships, and limited liability companies formed under the laws of any state, the District of Columbia, or the United States that:

- Do business in California

- Have total annual revenues exceeding $500 million USD

This threshold is lower than that of SB 253 (which applies to companies with revenues over $1 billion), meaning SB 261 will affect a larger number of businesses. It's estimated that over 10,000 companies may be subject to this regulation.

Why should you care about SB 261?

SB 261 is significant for several reasons:

- It sets a precedent for mandatory climate risk disclosure, which could influence similar regulations in other states or at the federal level.

- It helps investors, consumers, and policymakers make more informed decisions by providing transparency on companies' climate-related risks and strategies.

- It encourages businesses to proactively address climate risks, potentially leading to more resilient and sustainable business models.

- Non-compliance can result in penalties of up to $50,000 per reporting year (currently paused pending appeal).

How can Arbor help you with SB 261?

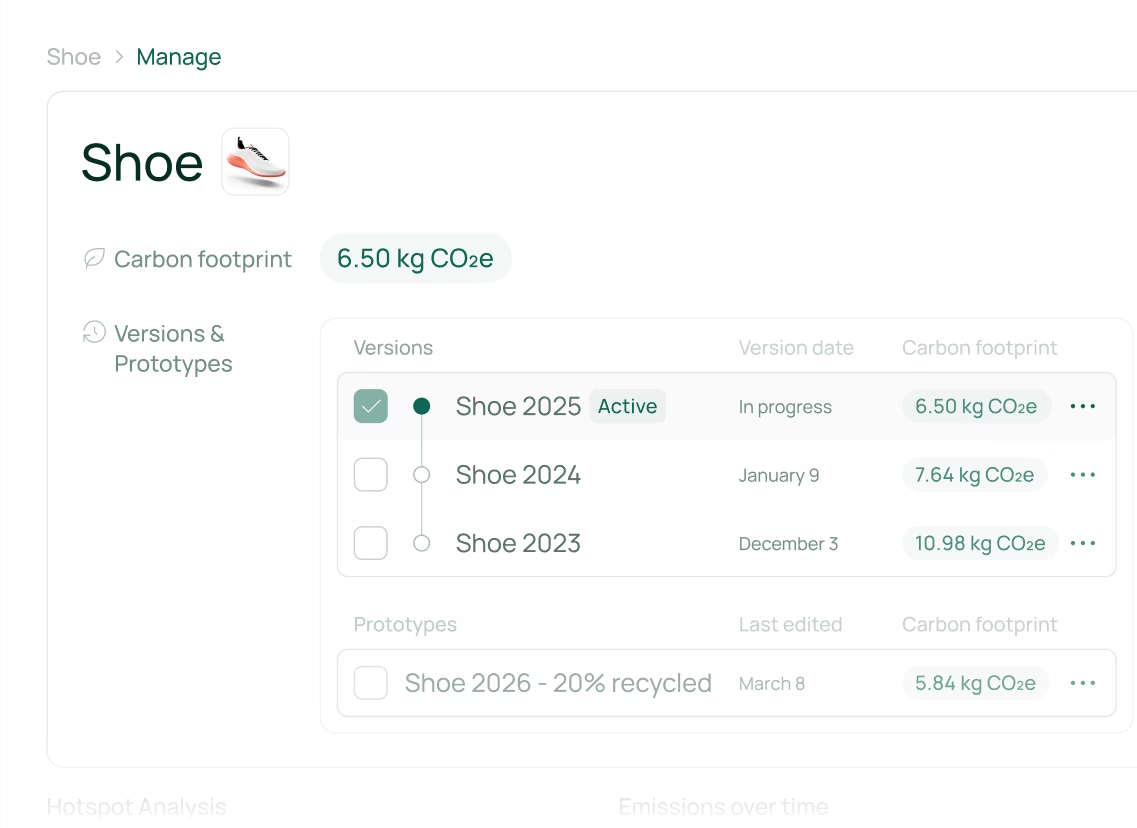

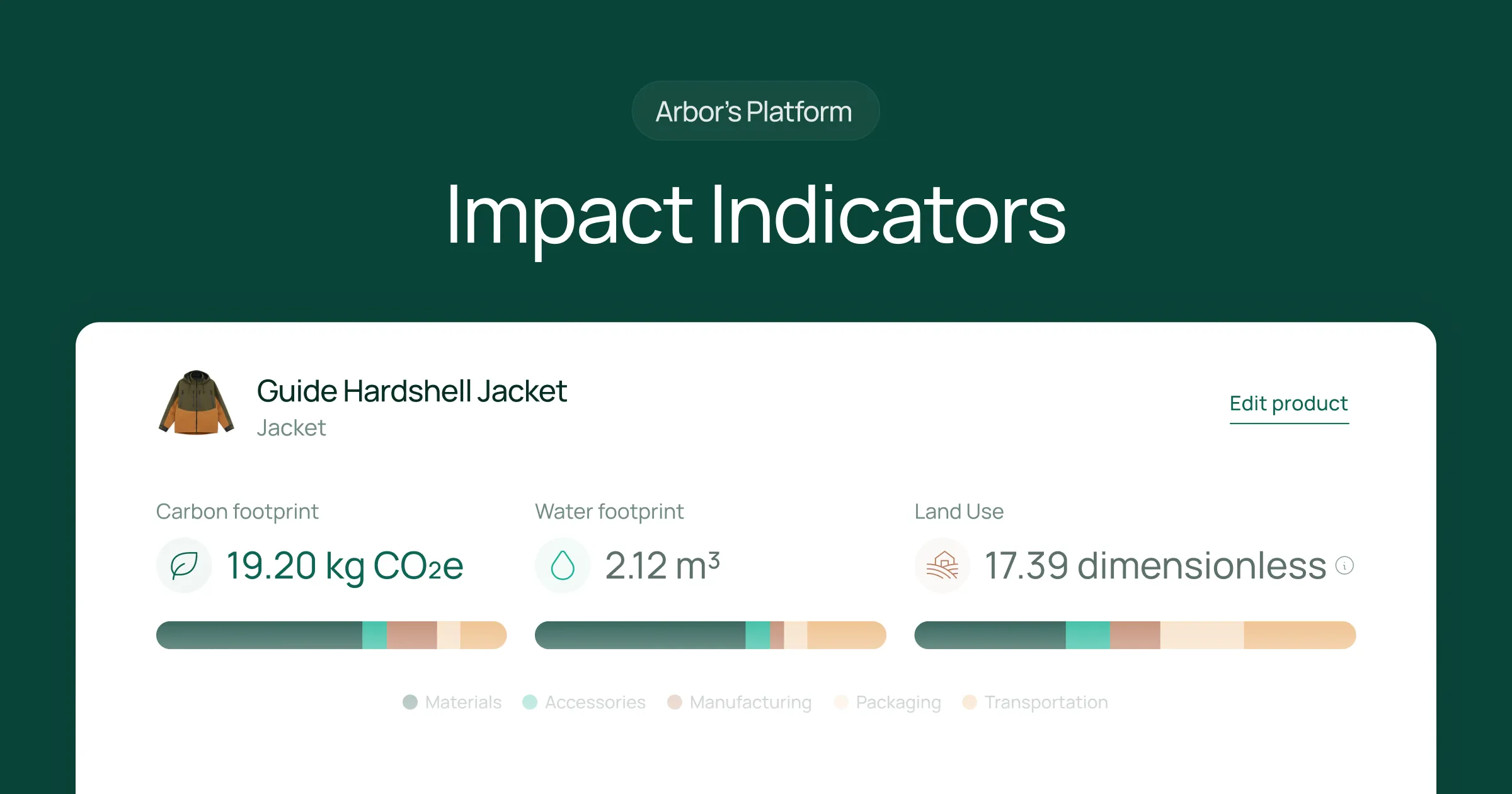

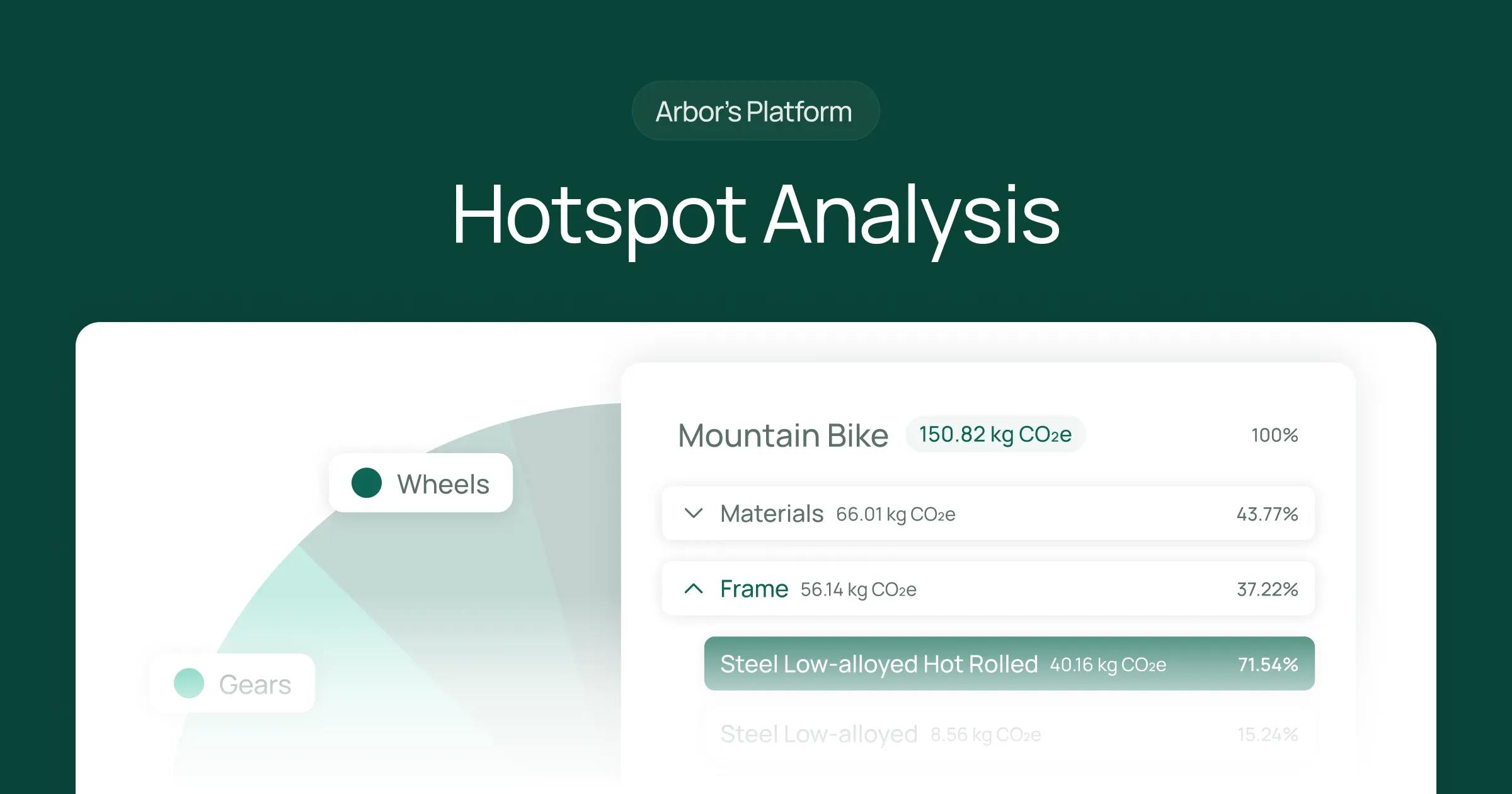

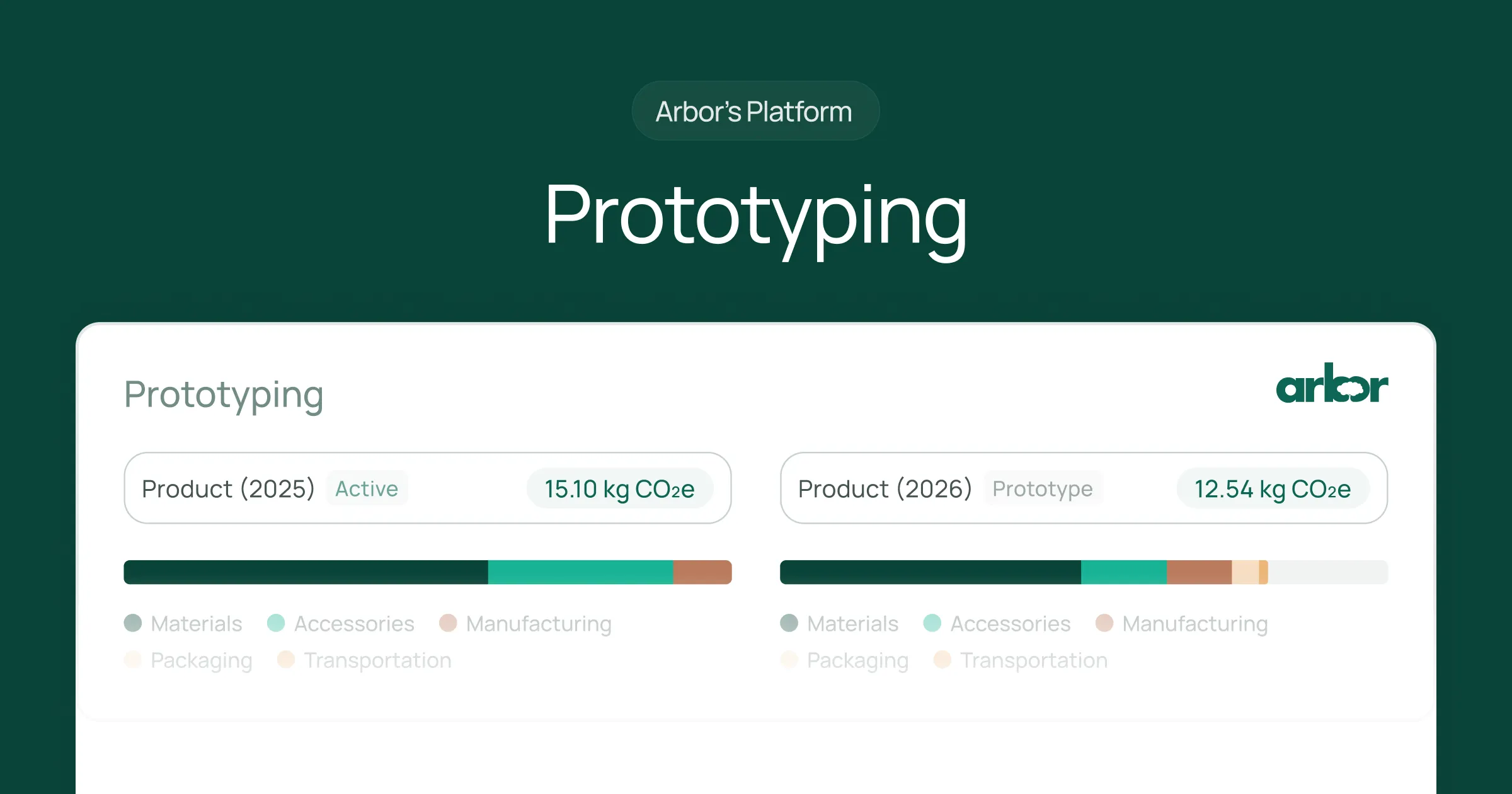

At Arbor, we understand the complexities of climate-related financial risk reporting and are here to support your compliance with SB 261. Our expertise in sustainability and carbon footprint calculation can help you:

- Assess your climate-related financial risks comprehensively

- Measure your carbon footprint with globally recognized standards

- Prepare TCFD-aligned reports that meet SB 261 requirements

- Implement systems for ongoing monitoring and reporting of climate risks

Our team of experts can guide you through the entire process, ensuring your reports are not only compliant but also provide valuable insights for your business strategy.

See how Arbor helps you with SB 261 reporting.

Summary

California's Climate-Related Financial Risk Act (SB 261) is a pioneering law requiring large companies operating in California to disclose their climate-related financial risks biennially.

Currently on pause due to a court injunction, SB 261 will require businesses with annual revenues over $500 million to prepare and publicly share reports aligned with TCFD recommendations.

This legislation aims to enhance transparency, promote sustainable business practices, and help stakeholders make informed decisions. With potential penalties for non-compliance, affected companies must start preparing now.

Another closely related, pressing law in California that businesses must be aware of is SB 253 - California’s Climate Corporate Data Accountability Act. Or see a combined overview of both SB 253 and SB 261.

See an overview of California’s SB 261 and California’s SB 253 to see how Arbor can help you get to compliance faster and avoid penalties.

Are you ready to report for SB 261 and turn climate risk disclosure into a strategic advantage?

Request a demo from Arbor today to learn how we can support your compliance journey and help you build a more resilient and sustainable business.

Measure your carbon emissions with Arbor

Simple, easy carbon accounting.

FAQ about SB 261

What is SB 261, and why was it enacted?

SB 261 is California's Climate-Related Financial Risk Act, enacted to enhance corporate transparency and accountability regarding climate-related financial risks. It aims to promote sustainable business practices and inform stakeholders about the climate risks businesses face.

Who is required to comply with SB 261?

Businesses operating in California with total annual revenues exceeding $500 million are required to comply with SB 261. This includes corporations, partnerships, and limited liability companies.

When do businesses need to start submitting reports under SB 261?

The first report is statutorily due by January 1, 2026, however, enforcement is currently paused by a court injunction. A voluntary docket is available for early submissions.

What is the role of the California Air Resources Board (CARB) in SB 261?

CARB will contract a non-profit climate reporting organization to review the submitted reports and prepare a public analysis. This analysis will assess the adequacy of the reports and highlight systemic and sector-wide climate-related financial risks.

What are the penalties for non-compliance with SB 261?

Companies that fail to comply with SB 261 may face penalties of up to $50,000 per reporting year, making it critical for businesses to adhere to the reporting requirements.

What kind of information needs to be included in the climate-related financial risk report?

The report should disclose climate-related financial risks in accordance with the TCFD recommendations. However, for the first report due in 2026, CARB has clarified that disclosing Scope 1, 2, and 3 emissions is not a minimum requirement.

How will stakeholders utilize SB 261 reports?

SB 261 reports will help investors, consumers, and policymakers make more informed decisions by providing transparency on companies' climate-related risks and strategies.

What frameworks should businesses use to prepare their reports?

Businesses are encouraged to follow the Task Force on Climate-Related Financial Disclosures (TCFD) framework when preparing their climate-related financial risk reports.

What’s the difference between SB 261 and SB 253?

SB 253, known as California’s Climate Corporate Data Accountability Act, applies to companies with revenues over $1 billion and focuses on broader climate-related data disclosure. SB 261 has a lower revenue threshold and emphasizes climate-related financial risks.

Can third-party organizations assist with SB 261 compliance?

Yes, third-party organizations like Arbor can assist with SB 261 compliance by helping businesses assess climate-related financial risks, develop mitigation strategies, and prepare TCFD-aligned reports.

How often must businesses update their climate-related financial risk reports under SB 261?

Businesses are required to update and submit their climate-related financial risk reports every two years (biennially).

Why is transparency about climate-related financial risks important for businesses?

Transparency helps stakeholders understand the risks and strategies businesses are employing regarding climate change, promoting more resilient and sustainable business models.

%20Directive.webp)

.webp)

%20Arbor.avif)

%20Arbor.avif)

.avif)

%20Arbor%20Canada.avif)

.avif)

%20Arbor.avif)

.avif)

_.avif)

.avif)

%20Arbor.avif)

%20Software%20and%20Tools.avif)

.avif)

.avif)

%20EU%20Regulation.avif)

.avif)

%20Arbor.avif)

_%20_%20Carbon%20101.avif)

.avif)

.avif)

.avif)