- California's SB 253 is a new law requiring large companies to report their greenhouse gas emissions.

- It applies to public and private companies with over $1 billion in annual revenue doing business in California.

- Companies must report Scope 1, 2, and 3 emissions, with reporting starting in 2026 for 2025 data.

- Third-party verification of the reported data is required, with standards becoming stricter over time.

- To prepare, companies should start collecting supply chain data, creating reporting templates, and considering carbon management tools like Arbor.

California is at the forefront of climate regulation with its Senate Bill 253 (SB 253). This legislation is a clear signal that transparency in corporate climate impact is no longer optional.

But what does this landmark legislation actually mean for your company? How does it change the reporting requirements for businesses like yours? And why is it so important to get this right?

In this guide, we'll break down the details of SB 253, look at its wider effects, and give you practical steps to comply and even find opportunities in this new regulatory environment.

Stick with us to understand not just how to meet these new standards, but also how embracing this shift can distinguish your company in a market that increasingly values transparency.

Understanding California’s Climate Corporate Data Accountability Act (SB 253)

California’s Climate Corporate Data Accountability Act, or SB 253, is a significant law designed to bring more transparency and accountability to corporate greenhouse gas (GHG) emissions reporting.

This law requires large public and private companies doing business in California, with revenues over $1 billion, to disclose their GHG emissions across their entire value chain. This includes Scope 1, 2, and 3 emissions.

What is SB 253?

SB 253 is a regulation focused on improving the transparency of corporate emissions reporting. It mandates detailed disclosure of GHG emissions from companies operating in California that meet a certain size threshold. The purpose of SB 253 is to give stakeholders, regulators, and the public access to reliable climate data. This is expected to encourage substantial carbon reductions and support California's larger climate objectives.

How does SB 253 work?

SB 253 introduces a structured timeline for companies to report their GHG emissions. It requires reporting of direct emissions (Scope 1), indirect emissions from purchased energy (Scope 2), and other indirect emissions, mainly from the supply chain (Scope 3). The law also mandates that a third party must verify the reported data to confirm its accuracy.

Key phases of SB 253 implementation:

1. Initial reporting

Starting June 30, 2026, companies will need to report their Scope 1 and Scope 2 emissions for the previous year (2025).

2. Expanded reporting

In 2027, companies must also report their Scope 3 emissions, based on data from 2026.

3. Verification

The verification process will start with limited assurance and become more stringent over time, moving to full reasonable assurance by 2030.

What are the requirements of SB 253?

SB 253 sets several important requirements for the companies it affects:

Comprehensive emissions reporting

Companies are required to report their Scope 1, Scope 2, and Scope 3 emissions in line with the Greenhouse Gas Protocol standards.

Third-party assurance

The reported data for Scope 1 and 2 emissions will initially need limited assurance, which will transition to reasonable assurance by 2030. The California Air Resources Board (CARB) is looking at standards like ISSA 5000, AA1000, ISO 14060, and AICPA.

Public registry

All emissions data must be submitted to a new public registry that will be managed by CARB.

Penalties for non-compliance

Companies that do not comply may face penalties of up to $500,000. In addition, CARB has proposed a flat annual fee of $3,106 to help cover the costs of the program.

When does SB 253 become mandatory?

The implementation of SB 253 is phased to give companies time to get ready:

- 2026: Reporting for Scope 1 and 2 emissions, based on 2025 data, becomes mandatory.

- 2027: Reporting for Scope 3 emissions, based on 2026 data, is required.

- 2030: Scope 1 and 2 emissions reporting will require reasonable assurance, while Scope 3 will need limited assurance, pending a review by CARB.

Who needs to comply with SB 253?

SB 253 applies to large public and private companies that have annual revenues of more than $1 billion and conduct business in California. This includes an estimated 2,596 companies across many different industries.

What’s the definition of doing business in California?

The definition of "doing business in California" is still being finalized by CARB. The latest proposal suggests a simpler approach than what was first considered. The new idea is to define a company as "doing business in California" if it is listed on the Secretary of State's public database as having a designated agent for service of process in the state.

Why should you care about SB 253?

Complying with SB 253 is important for a few key reasons:

Enhanced corporate responsibility

SB 253 makes companies accountable for their effect on the environment, pushing them to adopt more sustainable practices and lower their carbon footprints.

Competitive advantage

Being an early adopter of these regulations can give you a competitive edge. Companies that show leadership in sustainability are more likely to attract investors and customers who care about environmental responsibility.

Investor confidence

Clear and accurate reporting of emissions can increase investor confidence. Investors are increasingly looking for reliable data to evaluate climate-related financial risks.

Global alignment

SB 253 is in line with global sustainability efforts, which can make it easier for companies to standardize their emissions reporting across different regions.

Avoiding penalties

Not complying with the law can lead to large financial penalties. Following SB 253's rules helps businesses avoid these fines and stay in good standing with regulators.

Common mistakes to avoid for SB 253 compliance

For many companies, SB 253 will be their first time dealing with mandatory carbon reporting. The stakes are high, with potential penalties and risks to your reputation. Here are some common mistakes first-time reporters make and how you can avoid them.

Treating SB 253 as a one-time exercise

Some companies do a “rush” job just once to file a report. But SB 253 requires annual disclosure, and regulators expect to see improvement and accuracy over time.

If you treat compliance as a one-off task, you'll end up duplicating your efforts and losing valuable knowledge each year. Instead, you should build repeatable processes and create clear ownership for this work within your company. Think of it as a new system, not just a single project.

Ignoring Scope 3 emissions until the last minute

Many companies underestimate how challenging it is to calculate Scope 3 emissions and put it off until the deadline is near.

The problem is that Scope 3 can make up 70–90% of a company’s total carbon footprint, and collecting data from suppliers and supply chain partners can take months. You should start talking to your suppliers and collecting data now.

Create a plan that moves from using spending-based estimates to more accurate activity-based data.

Underestimating data governance and documentation

It's a mistake to collect raw data without keeping track of its sources, the assumptions you made, or the missing data gaps.

When auditors or regulators ask for proof, you need to be able to show them where your numbers came from. It's expensive and time-consuming to try to recreate this documentation later.

You should create a compliance trail by keeping all your original sources, notes on your calculations, and references to your data sources. Treat your emissions data with the same care as your financial data.

Waiting too long to get help

Some companies assume their internal teams can handle this new task on their own, without investing in training, tools, or outside help.

But making mistakes in the first year can lead to higher costs for assurance, penalties, and having to redo your work. It's better to bring in experts early, whether that means consultants or software solutions.

{{cta}}

How to prepare for SB 253

Getting ready for SB 253 requires a well-thought-out plan for collecting and reporting data from your entire business and supply chain.

Companies that get ahead of these requirements will be in a better position to comply and use this regulation to their advantage.

Here’s how you can start:

1. Supply chain data collection

Start gathering detailed data on GHG emissions from your whole supply chain. This involves working with your suppliers to track Scope 3 emissions, which can be tricky but are essential for SB 253 compliance.

2. Measure emissions

Measure your scope 1,2,3 emissions using the collected data. Fill in missing data gaps with trusted secondary data sources. Invest in a platform that can automate and simplify your emissions tracking and reporting.

3. Create public disclosure reports

Create draft reports of your emissions data that meet the Greenhouse Gas Protocol standards.

4. Engage with third-party verifiers early

Verification is a major part of SB 253. Start building relationships with accredited verifiers now to make the process smoother later.

5. Develop an internal compliance team

Put together a team that will be responsible for making sure your company is on track to meet the requirements of SB 253 every year.

How can Arbor help you with SB 253?

Dealing with the complexities of SB 253 can be a challenge, but Arbor is here to help. Here’s what we can do:

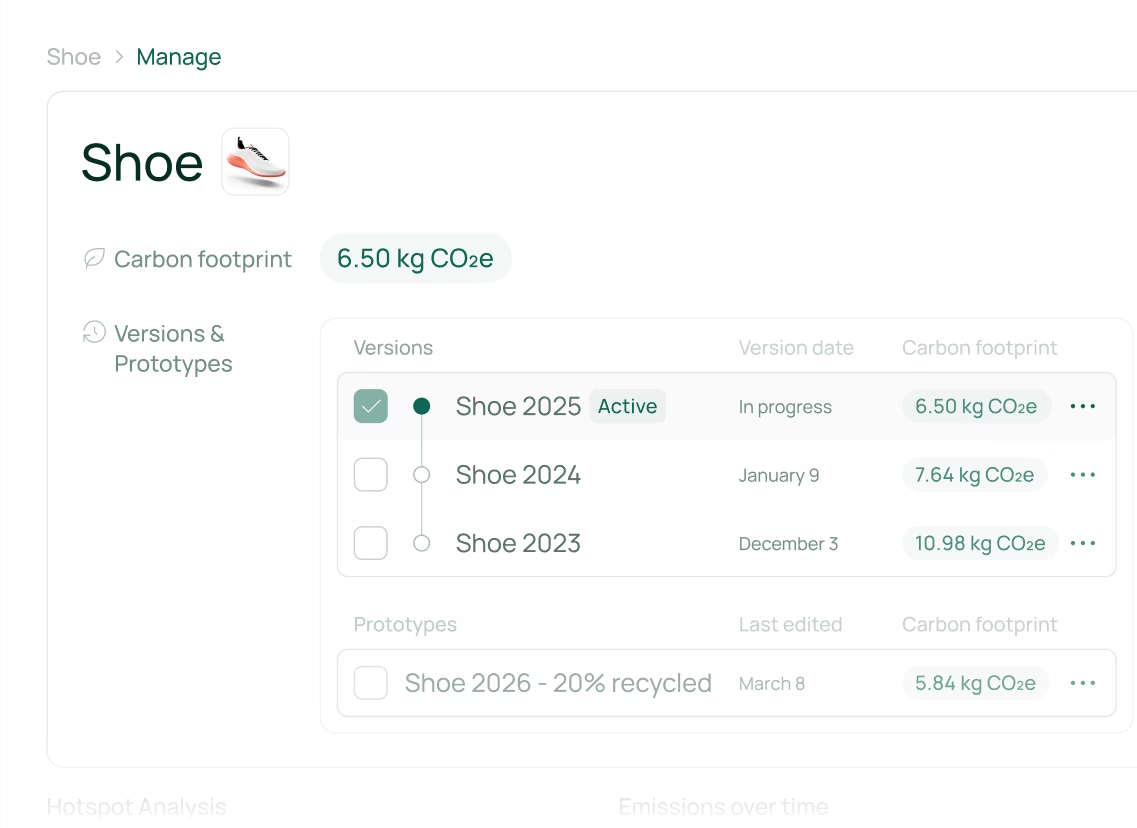

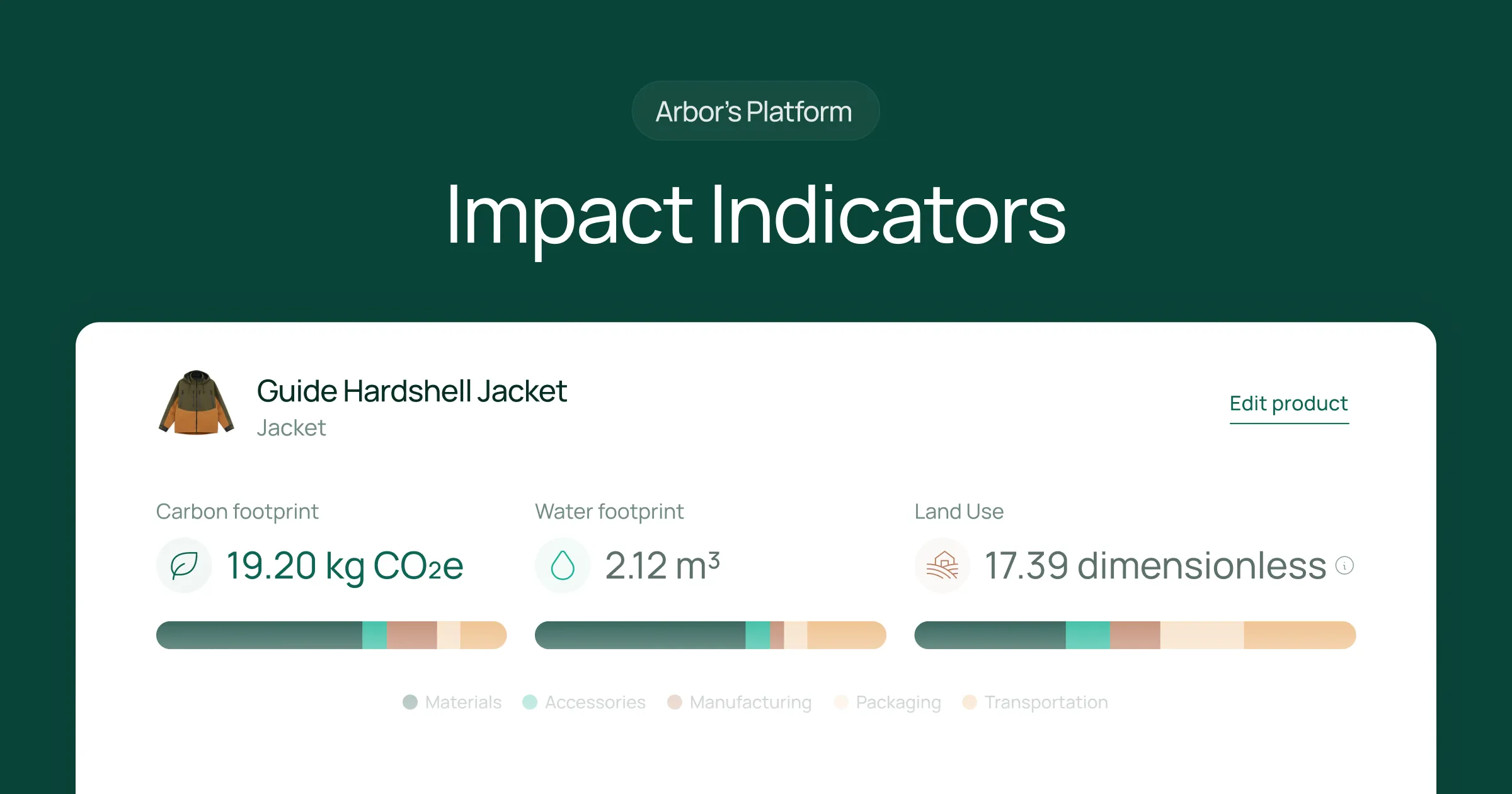

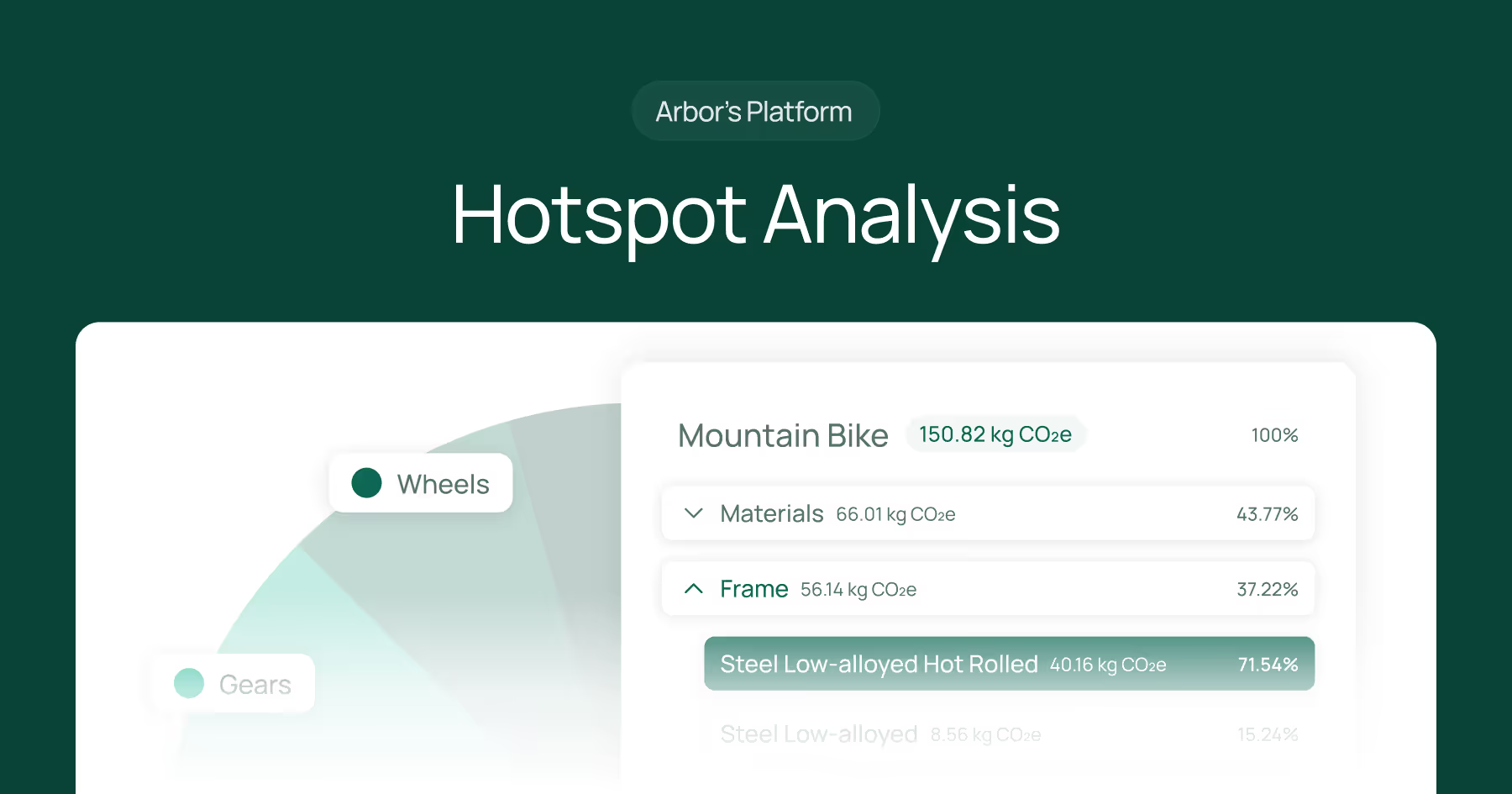

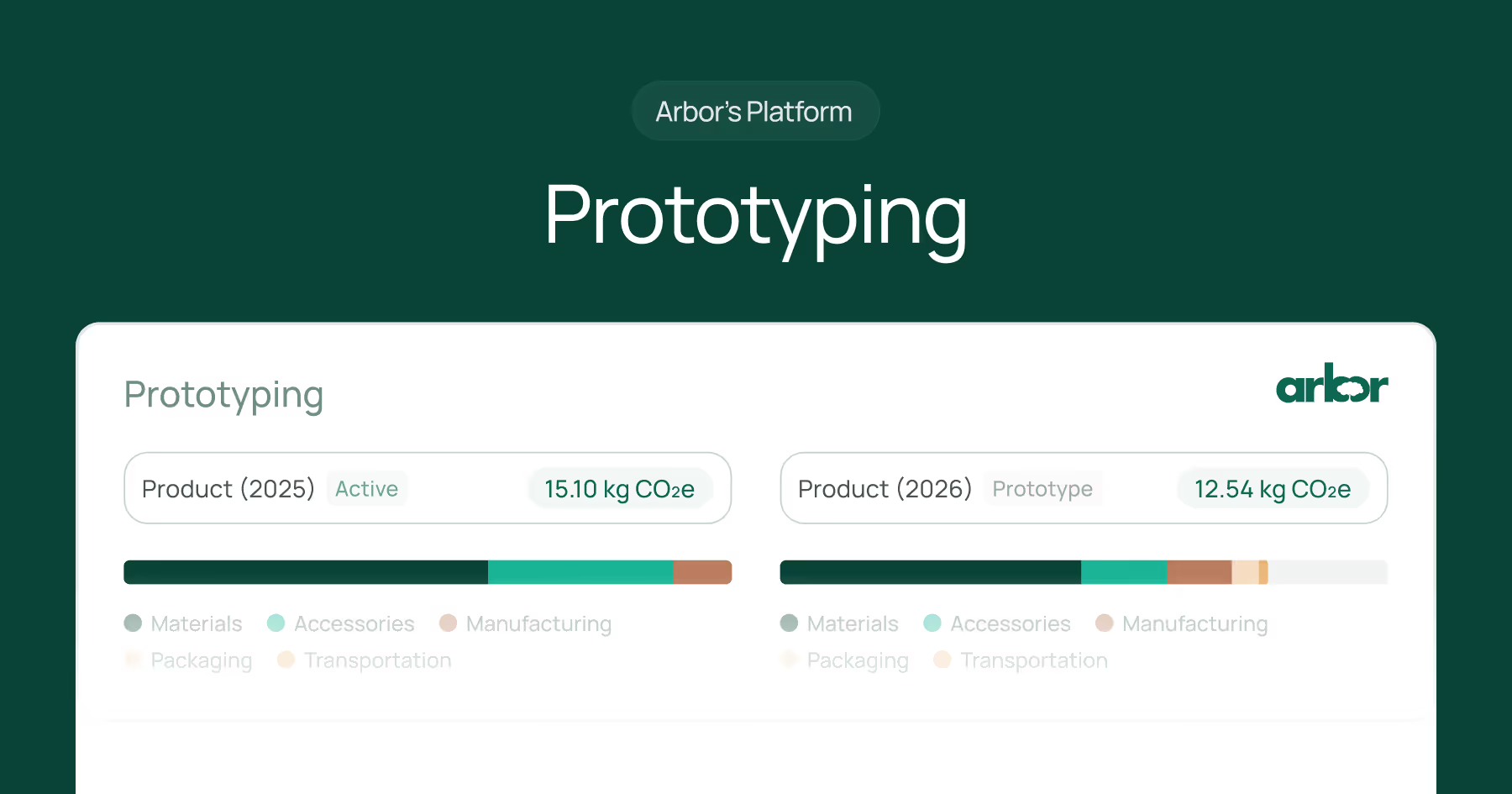

Comprehensive carbon accounting solutions

Arbor offers a carbon accounting platform that makes it easy to collect data and measure and report your GHG emissions across all scopes. Our platform helps make sure your data is transparent, traceable, and reliable.

Third-party verification support

We can connect you with accredited third-party verifier partners to help make sure your emissions data meets the necessary assurance levels.

Integration of climate risk into business strategy

Our solutions help you build climate risk management into your overall business strategy, making it easier to align with SB 253 and other global sustainability standards.

Ongoing regulatory updates

We keep you informed about the latest updates from CARB and other regulatory bodies. We'll let you know about any changes to SB 253 and help you adjust your compliance strategy.

Transparent communication

Arbor can help you create a clear communication strategy to share your sustainability progress and compliance status with your stakeholders.

See how Arbor helps you with SB 253 reporting

Summary

California’s SB 253 is a landmark law that marks a big step toward greater corporate accountability in GHG emissions reporting. For companies, this law is both a challenge and a chance to become a leader in sustainability. By understanding the requirements, preparing carefully, and using the right tools, companies can not only comply with SB 253 but also find a competitive advantage in a market that is increasingly focused on sustainability.

Another important California law to be aware of is SB 261, the Climate-Related Financial Risk Act. You can also see a combined overview of both SB 253 and SB 261.

See an overview of California’s SB 253 and California’s SB 261 to see how Arbor can help you get to compliance faster and avoid penalties.

Ready to comply with SB 253 and lead in corporate sustainability?

Request a demo from Arbor today to get started with our expert carbon accounting solutions and support!

Measure your carbon emissions with Arbor

Simple, easy carbon accounting.

FAQ about SB 253

What is the primary goal of SB 253?

The main goal of SB 253 is to increase transparency and accountability in corporate greenhouse gas (GHG) emissions reporting. This is intended to drive major carbon reductions and help California meet its broader climate goals.

How does SB 253 differ from other environmental regulations?

Unlike many other regulations that only look at direct emissions, SB 253 requires a full report of Scope 1, Scope 2, and Scope 3 emissions. This gives a complete picture of a company's carbon footprint, including its supply chain.

What’s the difference between SB 253 and SB 261?

SB 253 is about disclosing climate-related data, specifically GHG emissions, and applies to companies with revenues over $1 billion. SB 261, on the other hand, has a lower revenue threshold and is focused on climate-related financial risks.

What challenges might companies face in complying with SB 253?

Companies might find it challenging to collect all the necessary data, accurately measure Scope 3 emissions, get third-party verification, and fit the new reporting requirements into their existing sustainability plans.

How can SB 253 impact a company's supply chain?

SB 253 can create a ripple effect through the supply chain. Companies may need their suppliers to provide emissions data to report their Scope 3 emissions accurately, which can lead to more focus on sustainability throughout the supply chain.

.webp)

%20Arbor.avif)

%20Arbor.avif)

.avif)

%20Arbor%20Canada.avif)

.avif)

%20Arbor.avif)

.avif)

_.avif)

.avif)

%20Arbor.avif)

%20Software%20and%20Tools.avif)

.avif)

.avif)

%20EU%20Regulation.avif)

.avif)

%20Arbor.avif)

_%20_%20Carbon%20101.avif)

.avif)

.avif)

.avif)

.avif)